-

Home-Related Tax Deductions Tax season. Just the words can send shivers down your spine. But if you're a homeowner, there's a silver lining: potential savings! You’ve probably heard that you can deduct the interest you pay on your mortgage — but did you know there are many other ways homeowners can

Read More Buyers Gain Leverage as South Florida Market Slows

South Florida homebuyers are finding themselves in a stronger position as the housing market cools, offering opportunities for negotiation and discounts. Recent data from Redfin shows that homes are selling below asking prices, with longer listing periods, especially in coastal Florida markets like

Read More7 Smart Ways to Budget for Your 2025 Home Remodeling Project

Home remodeling expenses in the U.S. are projected to soar to $569 billion in 2025, despite a temporary dip in 2024, according to Statista. Whether you’re planning a complete home renovation or focusing on one area, the cost can range from $20,000 to $300,000 depending on factors like home size, pr

Read MoreBoost Your Credit Score: Essential Tips for 2025

Having a strong credit score is essential in 2025. Beside securing favorable rates on loans, credit cards, and mortgages even many Florida communities require a strong FICO score now. Below are some expert tips for boosting your credit score. If you'd like an analysis of your credit r

Read MoreHOAs Prohibited From Banning Pickup Trucks

Florida’s new law prohibiting homeowners associations (HOAs) from banning the overnight parking of pickup trucks has sparked significant debate among communities across the state. While the law aims to protect property owners’ rights, some HOAs are claiming exemptions and refusing to comply, citing

Read MoreUnderstanding the Federal Reserve and Its Impact on Mortgage Rates

The Federal Reserve (Fed) is a critical player in the U.S. economy, making decisions that influence interest rates, inflation, and financial markets. Homebuyers and real estate investors often feel its impact through changes in mortgage rates. Understanding how the Fed operates can help you make sm

Read MoreEnhanced Building Codes in Florida: A Positive Move for Home Safety and Market Stability

The recent implementation of stricter building codes in Florida, as enforced by the Federal Emergency Management Agency (FEMA), marks a significant development in the state's approach to reconstructing homes post-hurricane. This initiative aims to elevate homes and ensure they meet rigorous flood s

Read MoreHome Equity for Holiday Expenses?

The holiday season often brings increased spending on gifts, travel, and celebrations. With prices higher than in past years, it’s tempting to consider using your home equity to cover these costs. After all, home equity loans and lines of credit (HELOCs) typically offer lower interest rates than hi

Read MoreU.S. Home Prices See 4.3% Annual Increase in Q3 2024, Slowing Amid Rising Mortgage Rates

Key Takeaways for U.S. Real Estate Market InsightsIn the third quarter of 2024, average U.S. home prices grew by 4.3% compared to the same period last year, according to the most recent Federal Housing Finance Agency (FHFA) House Price Index (HPI). This represents continued growth, though at a more

Read MoreNew Home Mortgage Applications See 10.8% Annual Increase, Reflecting Strong Buyer Interest

In September 2024, mortgage applications for new home purchases increased by 10.8% compared to the same month last year, reflecting the ongoing appeal of newly built homes despite fluctuations in market conditions. The Mortgage Bankers Association’s (MBA) Builder Application Survey (BAS) shows that

Read MoreProactive Steps for Homebuyers: The Importance of Reviewing Your Credit Report

When preparing to buy a home, checking your credit report is a key step to ensuring smooth financing. Reviewing your report at least once a year helps keep your credit profile accurate and boosts your chances of qualifying for a mortgage with favorable terms. Understanding Your Credit

Read MoreBest Florida Cities for Retirement Bliss

When it comes to retirement, Florida continues to be a top choice. WalletHub recently ranked four Florida cities—Miami, Orlando, Fort Lauderdale, and Tampa—among the nation’s best places to retire, thanks to low taxes and high-quality healthcare. Why Florida Ranks So High for Retirees Florida attrac

Read MoreMortgage Help for Homeowners After Hurricanes

After a hurricane, the stress of dealing with damages is overwhelming—and so is keeping up with mortgage payments. Fortunately, if your mortgage is backed by Fannie Mae, Freddie Mac, or the Federal Housing Administration (FHA), there are programs available to provi

Read MoreFlorida Condo Buyers: New Structural Reports You Need to Know by Dec 31!

Florida Condo Associations Face New Reporting Requirements by December 31, 2024 As the December 31, 2024, deadline approaches, many Florida condo associations are required to complete two key inspection reports that could significantly impact condo buyers, sellers, and current owners. These reports

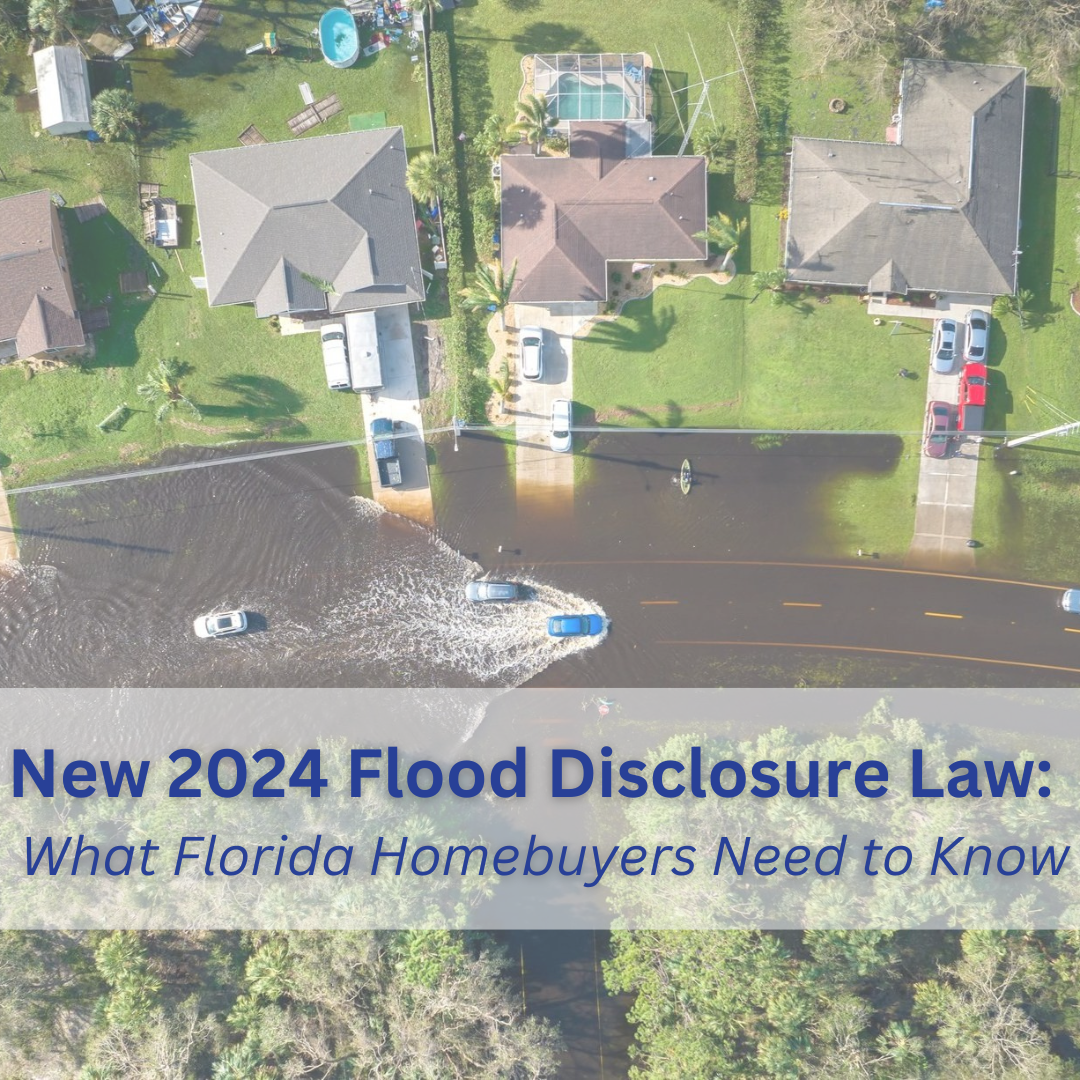

Read MoreNew 2024 Flood Disclosure Law: What Florida Homebuyers Need to Know

Starting October 1, 2024, Florida will implement a new flood disclosure requirement for residential real estate transactions. According to Florida Statute 689.302, sellers must now provide a flood disclosure to potential buyers at or before the time a sales contract is signed. The fl

Read MoreBroward County Real Estate Sees Surge Amid Lower Interest Rates

As the year progresses, positive trends have emerged in the real estate market, particularly with interest rates hitting their lowest levels in over a year. This has sparked increased activity among homebuyers and homeowners looking to refinance their loans. Interest Rate Drops Fuel Mortgage Applic

Read MorePositive News on Florida’s Property Insurance

Florida's property insurance market is showing promising signs of improvement, thanks to recent reforms and initiatives aimed at reducing costs and expanding coverage for homeowners. For first-time homebuyers and homeowners in Broward County, this news is especially relevant as it impacts both

Read MoreEssential Tips for First-Time Homebuyers in Broward County

Purchasing your first home is a significant milestone, but it can also feel overwhelming. By taking the right steps and working with professionals, you can approach the process with confidence. Here's a deeper look at essential tips for first-time homebuyers in Broward County. 1. Estab

Read More7 Mistakes to Avoid When Hiring a Contractor

A recent survey found that more than half (52%) of American homeowners have a renovation project planned this year.1 If you’re among them, you know that embarking on home improvements can be both exciting and daunting. According to the survey, the median renovation budget is around $15,000, so you'

Read MoreUnlock the Door to Your Dream Home with Florida's Hometown Heroes Housing Program

Are you a dedicated member of our community workforce in Florida? Dreaming of owning a home? The Florida Hometown Heroes Housing Program is returning on July 1st, 2024 to turn your dreams into reality by making homeownership more affordable than ever for eligible community heroes like you!

Read More

Categories

Recent Posts